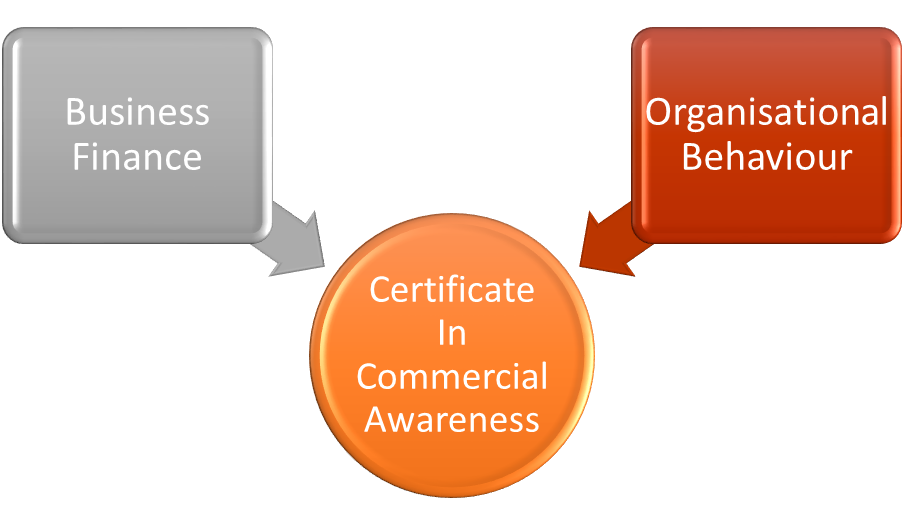

Course Content

Part 1 – Business Finance

1.Evaluating a Financial Case

- Purpose of Building a Financial Case

- Techniques used for evaluating a Financial Case

- Payback

- Calculation

- Payback and Risk

- Limitations of Payback

- Discounted Cash Flow /Net Present Value

- Purpose

- Calculation

- The NPV Decision Rule

- Internal Rate of Return

- How to derive IRR

- How IRR is used

- The IRR Decision Rule

- Payback

2.Budgeting, Costing and Pricing

- Budgets and Departmentalised Businesses

- The purpose of budgets

- Reasons for departmentalization

- Cost centres and profit centres

- Cash Flow and Cash Management

- Cash flow forecasting

- Use of cash flow in decision making

- Cash flow and profit

- Costing and Pricing

- Fixed and Variable costs

- Direct and indirect costs

- Break even and Contribution Analysis

3.Financial Reporting and Analysis

- Statement of Financial Position (Balance Sheet)

- Purpose and Structure

- The nature, purpose and types of Capital

- Current and non-current liabilities

- Current and non-current assets

- Income and Expenditure (Income Statement, Profit and Loss Account)

- The importance of Operating Profit

- Revenue (turnover)

- Cost of Sales

- Administrative Expenses

- Profit after Tax

- Statement of Cash Flows (Cash Flow Statement)

- Ratios (formulae and interpretation)

- Profitability Ratios: Operating Margin and Return on Capital Employed ratios

- Liquidity (Cash Management) Ratios: Current and “Acid Test” ratios

- Gearing (Leverage) Ratio: Debt/Equity Ratio

Part 2 – Organisational Behaviour

1.Market analysis and competitive advantage

- Analysing the business domain - Porter’s Five Forces Analysis

- Analysing the portfolio - Boston Box

- Delivering value - Porter’s Value Chain

2.Organisational behaviour and culture

- What is organisational behaviour?

- Organisational effectiveness and the Balanced Scorecard

- Understanding and analysing culture

- Organisational Cultural Types (Deal and Kennedy; Handy)

- International Cultures (Hofstede)

- The Cultural Web

3.Group formation

- Groups and group dynamics

- Formal and informal groups

- Groups and group tasks

- Characteristics of formal groups

- Homan’s theory of group formation

- Tuckman and Jensen’s theory of group development

- Characteristics of informal groups

- Social networks

4.Principles of organisational structure

- Organisation structuring

- Elements of organisation structure

- The six Structure Levels

- The Leavitt Diamond

- Types of jobs

- Work specialisation

- Flat and tall hierarchies

- Span of control

- Line, staff and functional relationships

- Formalisation of rules and procedures

- Centralisation v decentralisation

- Advantages

- Disadvantages

5.Operating models

- Organisation structures and their characteristics

- Functional

- Divisional – product or service/ geography/ customer

- Matrix

- Team-based – cross functional/ project

- Organisational boundaries

- Boundaryless organisations

- Outsourcing

- Offshoring

- Hollow organisation structures

- Modular organisation structures

- Virtual organisations

- Collaborations and strategic alliances

ENQUIRE

ENQUIRE

REQUEST CALLBACK

REQUEST CALLBACK

GET A FREE QUOTE

GET A FREE QUOTE

Introduction

Introduction Course Details

Course Details Course Content

Course Content

London

London